Case Study 1

Sale of SaaS company to a public company Buyer

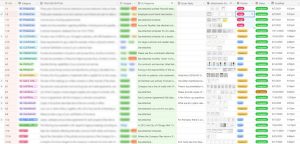

Click on an image to enlarge

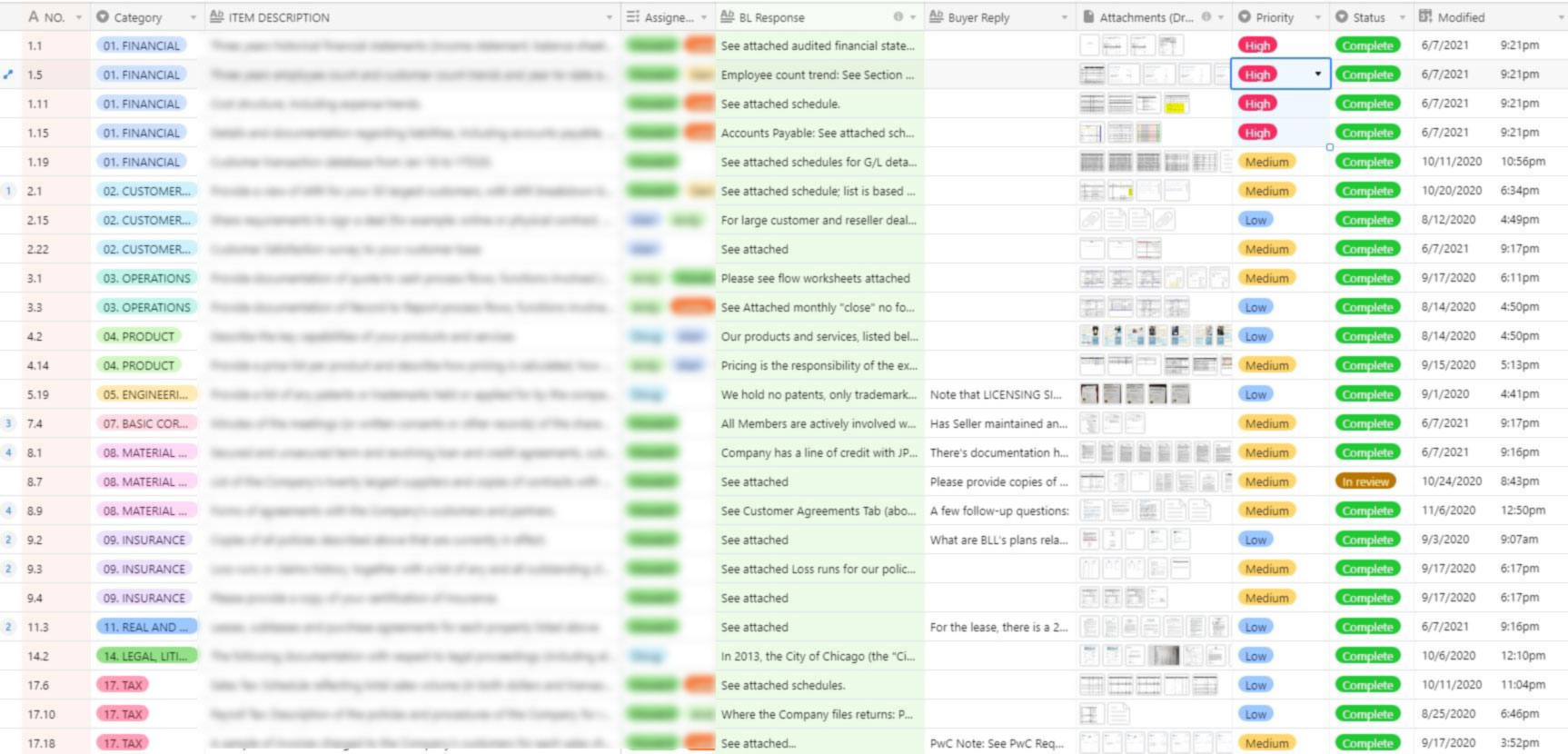

Turning Documents into Data

Turning the Data into Actionable Items

Managing the Data

THE CHALLENGE:

- Transaction value ~$100 million

- Seller’s small management team of 6

- Deal was confidential and only known to management team; employees were only informed on closing

- Buyer’s due diligence team of 35 employees and advisors

- 475+ detailed diligence requests across 18 subject areas

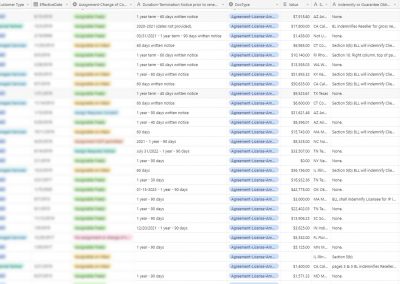

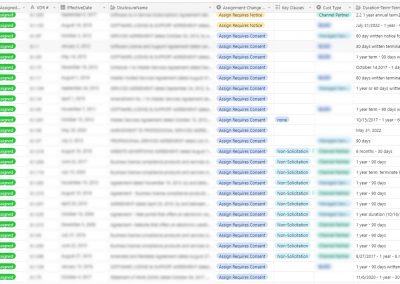

- Asset sale – all customer agreements, licenses, material contracts had to be scrubbed for consents and other contractual obstacles

- Seller had to manage the transition of employment to Buyer of over 100 employees.

THE SOLUTION:

Utilizing our licensed DEAL DRIVERSM platform, Flatiron did the following:

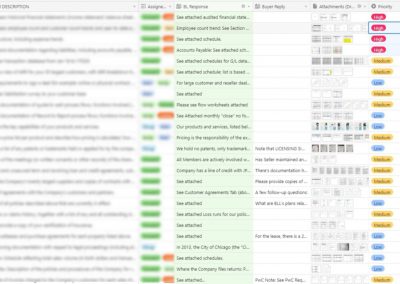

Managed the Data

- Created a comprehensive digital platform for Seller (organized for Buyer’s needs)

o captured, managed and optimized responsive documents

o presented data to Buyer in a transparent way

o collaborated with Buyer in an interactive, real-time environment.

- Mined the data using Deal Driver tools to extract actionable intelligence, including

o assignability of contracts

o exclusivity and competition restrictions

o IP rights

◦ Contract value

◦ Duration

◦ Customer location

◦ Indemnification obligations

Turned Documents into Data

- Organized Buyer’s due diligence requests and proposed representations and warranties into a live database of clauses.

- Clauses were linked directly to the associated Seller data (critical Deal data was always accessible to key decision makers).

- Additional requests, comments and questions managed in real time by relevant experts on the platform.

Turned the Data into Actionable Items in Real Time

- Leveraged Seller data (linked to associated Buyer requests) on Deal Driver to produce Seller deliverables:

◦ Collaborative and interactive diligence production

◦ Disclosure schedules

◦ Assignments and Consents lists

THE OUTCOME:

- Seller managed a massive due diligence project with a small team

- Continued day-to-day business operations.

- Deal closed successfully.

- Flatiron’s process produced better, more detailed, more organized information.

- Issues were surfaced, vetted and resolved early, without delaying the Deal

- Both parties appreciated database structure which optimized post-closing integration

- Logistics were handled efficiently, at a much lower cost than a traditional deal.

- Flatiron’s legal fee was less than half of the counter-party Big Law firm.