Credit & Acquisition Finance

Flatiron lawyers have decades of experience representing clients borrowing and lending money. Mark Haddad, one of our founding partners, chaired the Global Project Finance practice and was practice head of the Asian Banking & Finance practice at an AM Law 10 global law firm.

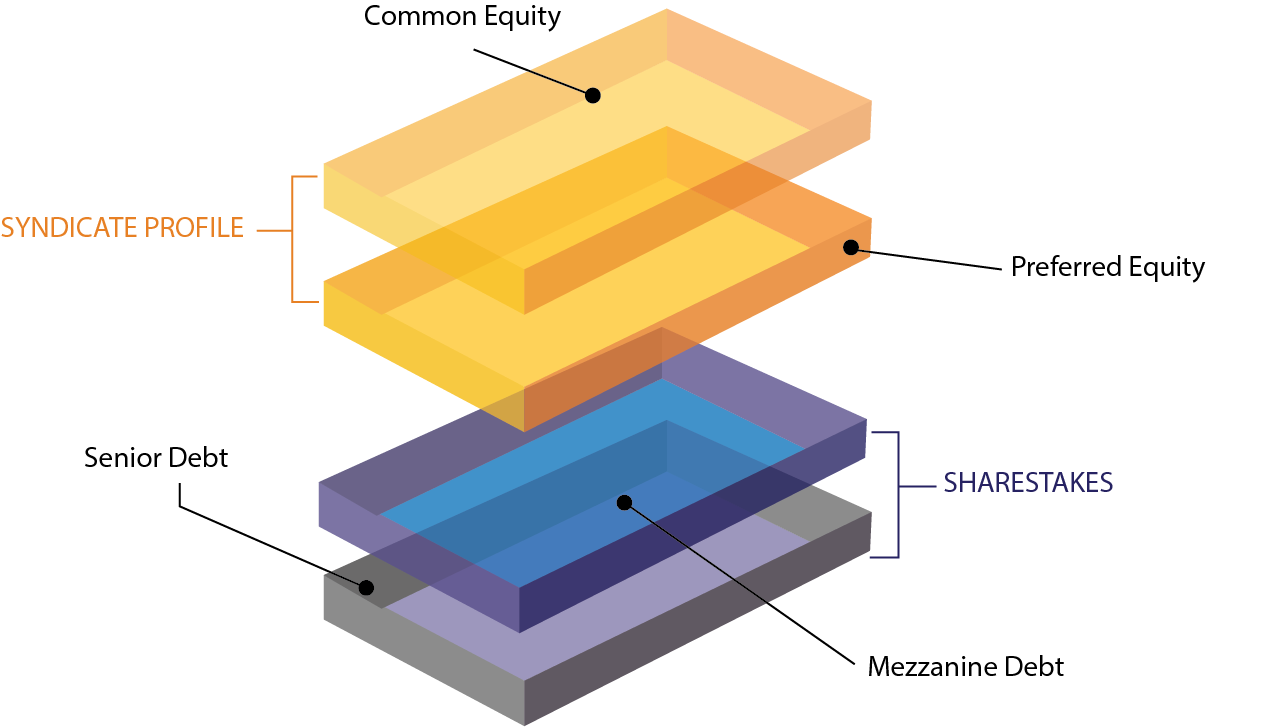

Flatiron can handle all variety of debt products, including asset-based loans, revolving credit facilities, bridge loans, mezzanine financings and subordinated notes. Our lending team also supports our M&A practice, driving leveraged and acquisition finance deals for strategic buyers and PE funds. Whether you need financing to fund a bolt-on acquisition or to plug a hole in your debt stack for a buy-out transaction, we have the skills to close your M&A. Our ability to work across capital structures enables us to be more efficient in negotiating and executing transactions.

Our lending team also supports our entrepreneurs and start-up companies with raising both traditional and non-traditional types of debt financing, including venture backed loans, non-bank loans, hybrid debt/equity arrangements and convertible note and SAFE facilities.

“Mark and the Flatiron team go above and beyond on each engagement. They assisted on a complex asset-backed financing deal we closed recently. Mark knocked it out of the park: winning deal points, providing us with a technical understanding and seeing the deal through to a timely close on budget.”

Joshua Dannett

Chief Operating Officer

Noble House Home Furnishings LLC.

“Mark Haddad helped guide us through the financing process on an innovative structure which was subsequently recognized by Project Finance Magazine as one of their “Deals of the Year”. I particularly appreciated being able to use a Partner who didn’t overstaff the engagement and nevertheless crafted tight documents.”

Managing Director, Renewable Energy, American Electric Power.