Business Succesion Planning

Mark Haddad leads our Business Succession Planning

Practice.

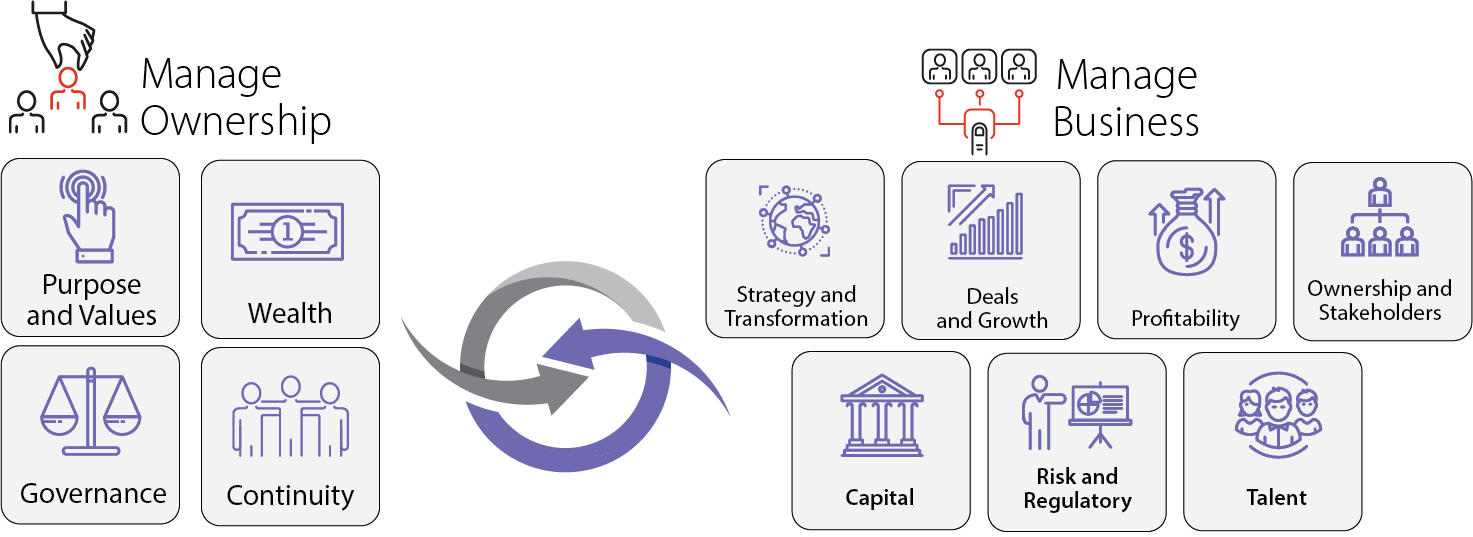

As part of the transaction lifecycle, Flatiron counsels founders, entrepreneurs, owner-managers and family-owned businesses with succession planning, exit strategy and wealth management to optimize tax outcomes and promote financial objectives. Whether your goal is to preserve wealth for family or to support philanthropic causes, or both, we have the expertise to structure with the best outcome in mind.

Our services include:

- Continuity and succession planning

- Defining purpose and values with a family charter

- Wealth planning and coordination of corporate and estate tax advice

- Family office for better control, privacy and risk management

- Board composition and responsibilities

- Financing and deal opportunities

Components of a Continuity Plan

Vision for family, business and wealth

Vision for family, business and wealth

Business and family governance

Business and family governance

Family

Family

employment

Ownership of business

Ownership of business

Philanthropic goals

Philanthropic goals

We understand the interests of the various stakeholders as the business evolves from the founder making all the business decisions to bringing in more family members and establishing more structure as the business grows and becomes more successful.

Our lawyers are experienced in organizing philanthropy through both family and business vehicles, such as trusts, private foundations and corporate giving programs. We take a holistic approach in helping families to achieve their goals as a unifying means of expressing the family’s ethical values and beliefs.