Case Study 2

Transactional Support Services

Case Study: Flatiron was engaged by a drug rehabilitation center at the request of a major private equity fund for the purpose of optimizing the corporate structure of the Client for possible sale. The business was distributed over 20 companies jointly owned by the two principals and assembled over a period of twenty years. The complexity of the corporate structure was deterring the prospective Buyer from applying the resources necessary to conduct a full-blown due diligence investigation of the business.

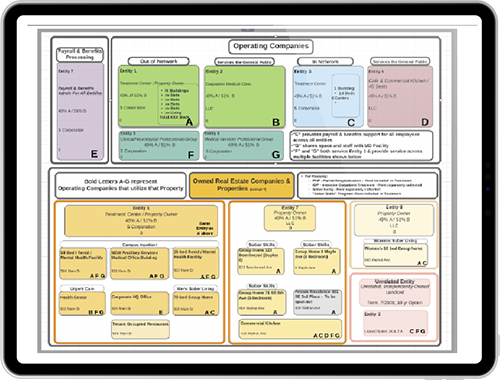

What Flatiron did: Flatiron extracted data from its relational database to create a one-page, multi-layered org chart that rationalized the complex capital structure. The chart showed that, underneath all of the noise, the Client consisted of only two core businesses, an insured business and a non-insured premium wealth business. Those businesses needed to be kept separate for regulatory purposes. All of the other companies were non-core, involving payroll, real estate ownership or ancillary services. Those ancillary businesses were not critical to the deal and could be coupled or de-coupled at the Buyer’s convenience.

The Outcome: With the complexity resolved, the prospective Buyer had the comfort to invest in a comprehensive due diligence investigation. In the end, the PE fund decided not to proceed with the deal for other business reasons. This exercise precipitated the Client’s decision to then recapitalize its business.